‘Twas the weeks before the holidays, when we heard from Jungle Scout,

“Who was buying what?” We just had to find out.

Popular products and spending were reported with care,

With a glance into the New Year, and time to prepare.

Consumers keep shopping for families and friends,

Let’s take a closer look at Jungle Scout’s Consumer Shopping Trends!

Based on a survey of 1,000 U.S. consumers, Jungle Scout reported on spending habits, preferences, and the influence of current events, providing a comprehensive look at the holiday shopping landscape.

Shopping Small Surges as Amazon Reigns Supreme

This year, a noteworthy trend emerges as consumers increasingly prioritize small and local businesses for holiday shopping, with one in five shoppers actively seeking gifts from these enterprises—a doubling of the statistics since 2022. Despite this surge, Amazon maintains its dominance, attracting a staggering 67% of U.S. consumers for holiday presents.

Generational Dynamics on Black Friday and Cyber Monday

Black Friday and Cyber Monday remain key focal points for holiday shopping, especially for younger generations. The report highlights that 60% of Gen Z and 55% of Millennials are expected to participate in Black Friday, contrasting with the more conservative figures of 30% for Baby Boomers and 36% for Gen Xers.

Spending and Ecommerce Landscape

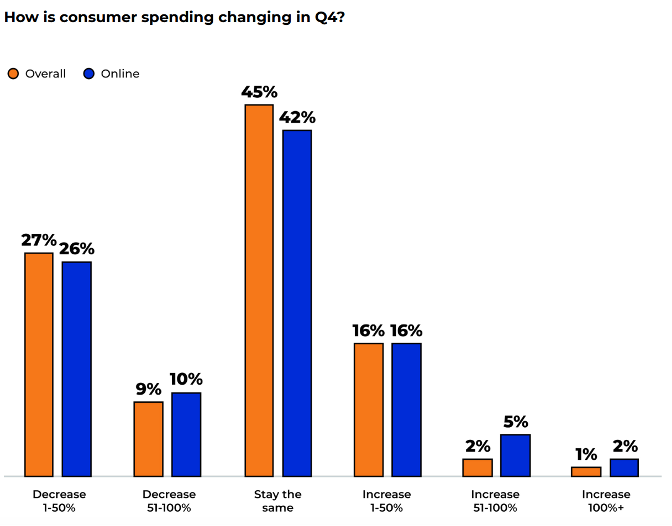

Jungle Scout’s historical view reveals intriguing patterns in consumer spending. While only 19% increased their spending in Q4, more budgets stayed level than decreased. Online spending takes the spotlight, with 23% reporting an increase compared to the previous quarter. Notably, spending on cleaning supplies, groceries, and pet supplies is on the rise, while categories like garden and outdoor, electronics, and home and kitchen see a decrease.

Ecommerce Challengers and Economic Concerns

SHEIN and Temu, newer entrants to the ecommerce space, are gaining traction, with nearly a quarter of U.S. consumers shopping from these platforms in the past three months. Economic concerns persist, with rising inflation rates and increased costs impacting consumer sentiments.

Shifting Priorities and New Year Resolutions

As 2023 draws to a close, consumer priorities are transforming. The majority (68%) entered Q4 with unchanged incomes, and most consumers plan to re-evaluate budgets in the new year. Family, physical, and mental health and well-being take precedence over career concerns. Interest in spirituality, hobbies, and outdoor activities has surged, while New Year’s resolution commitments have declined from 57% to 42% compared to the previous year.

Evolving Holiday Shopping Strategies

The report explores the evolving landscape of holiday shopping strategies, revealing that 42% of consumers planned to start shopping by the end of September. Interest in end-of-the-year sales events, including Black Friday, has decreased compared to the previous year, particularly among younger generations. Notably, 46% of Millennials shopped during Amazon’s Prime Big Deal Days event, while Black Friday saw the largest decline in consumer interest.

Local Businesses Take Center Stage

Support for local businesses is on the rise, with 20% of consumers actively seeking gifts from local and/or small businesses—a significant increase from 10% in 2022. Specialty, independent, local, or boutique businesses have surpassed big-box stores, reflecting the growing interest in shopping small and local.